08.02.2024

The Gift of Education

August is “back to school” month, or as we used to call it in my home when three boys were bouncing off the walls, “hostage release” month!

The ritual of educating our next generations is among the greatest legacies a family can provide to their children and grandchildren. With the proliferation of private schools, what may have once been a college funding objective can easily turn into a serious investment starting with pre-school.

And it is an investment, which we hope is fully appreciated, that will be utilized to further the life and aspirations of our offspring.

The families we serve at Proquility have, with few exceptions, made planning around education funding a top priority. In 1996, the tax law was changed to create “529” college education accounts to make saving and investing for this objective easier and more tax efficient. It also permitted those in a financial position to fund up to 5 years of annual gifts “up front,” providing substantial upfront leveraging of annual gift limits.

The first “529” account I helped a client establish was by a grandmother for the benefit of her newborn grandson. She was in the financial position to make the maximum gift to this account, which at the time was $50,000, and by the time her grandson started college in 2014, it had grown to over $210,000. Used for qualified educational expenses, these funds were distributed tax free to fully pay for this young man’s undergraduate education, as well as his Master’s Degree.

A wonderful legacy, and one that was repeated multiple times over three generations for that particular family.

Over the last 28 years, the potential maximum “529” account deposit limits have grown. Today, individuals can gift up to $90,000 ($180,000 for couples) to a 529 plan due to increased annual gift limits. But any amount can be used to open and fund a “529” account, so depending on family resources even smaller amounts set aside can grow to be a meaningful contributor to the rising costs of higher education. Recent changes to the rules around “529” accounts now also permit up to $10,000 per year per beneficiary to be used toward K-12 private school costs.

What if a family finds itself in the fortunate position where all of the “529” assets aren’t needed for college? Perhaps due to scholarship or a choice of an in-state school?

“529” assets can be shifted to other beneficiaries within the extended family, including siblings and cousins. And effective 2024, in perhaps one of the most consequential changes impacting an excess “529” asset situation, funds may be shifted to a tax-free Roth IRA for the beneficiary if certain qualifications are met:

- The “529” account has been established for at least 15 years

- The beneficiary has earned (W-2) income permitting a contribution to a Roth IRA

- A current maximum lifetime rollover amount of $35,000 in assets from “529” to Roth IRA, limited to the maximum annual Roth IRA contribution ($7,000 in 2024) for the beneficiary

Whether investing for education or another priority, time plays a crucial role in your chances of success. If helping your loved ones with their future educational expenses is a goal, starting the savings and investment process sooner than later will make a substantial difference when a young adult is ready to start their college career.

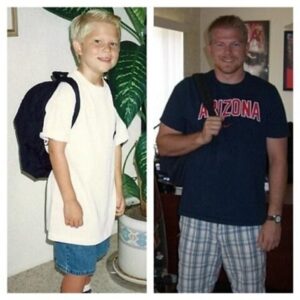

The photo below of my oldest son Alex demonstrates how quickly time goes by – his first day of Kindergarten (1995) next to his last day of College (2012)!

Andy, Patty, and the Proquility team