07.28.2022

Mapping out a Family Money Tree

Have you ever sat down and thought about where your ideas about money came from? It’s an interesting exercise to go through.

We tend to find that our beliefs about money stem from narratives handed down from past generations. Just like genetics influence your physical wellbeing, your money “programming” influences thoughts, decisions, and behaviors.

We’ve all heard of a family tree, but what about a Family Money Tree? Maybe it would be a good idea to map it out.

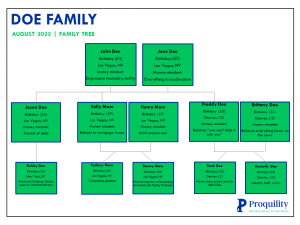

Here’s an example.

As you create your Family Money Tree, ask yourself these questions:

- Who on the Tree had the biggest influence on your attitude towards money – specifically, saving, spending, and investing?

- Do you maintain all the beliefs passed to you through the Tree, or did you adopt a different attitude?

- Which beliefs do you want to maintain, and which ones do you want to curtail?

- What beliefs are you handing down to your next generation about money? Do you think these beliefs are healthy, or could they be improved?

It’s an important exercise to go through. As human beings, we’d like to believe that we always act rationally when it comes to important decisions, putting logic over emotion. However in reality, we are more subject to our emotions that we realize – even if it’s on a subconscious level.

Why does all this matter?

If you are looking to create a legacy for the future generations, start by understanding what your family’s history has been in terms of beliefs and attitudes. Without doing this, it’s likely you’ll allow unhealthy money attitudes to sustain themselves.

You don’t need a financial advisor to help you with this, but if you ever want to discuss this or any other topics I cover in my newsletters, please feel free to send me a note.

-Andy

This content is limited to the dissemination of general information regarding its investment advisory services to United States residents residing in states where providing such information is not prohibited by applicable law. Accordingly, the publication of this content on the Internet should not be construed by any consumer and/or prospective client as the Firm’s solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Furthermore, this content should not be construed, in any manner whatsoever, as the receipt of, or a substitute for, personalized individual advice from the Firm. Any subsequent, direct communication by the Firm with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the states where the prospective client resides. For information pertaining to the registration status of the Firm, please contact the United States Securities and Exchange Commission on their website at www.adviserinfo.sec.gov. A copy of the Firm’s current disclosure statement discussing its business operations, services, and fees is available from the Firm upon written request. The Firm does not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Firm’s website or incorporated herein, and takes no responsibility therefore. All such information is provided for convenience purposes only and all users thereof should be guided accordingly.